Credit Score Analysis

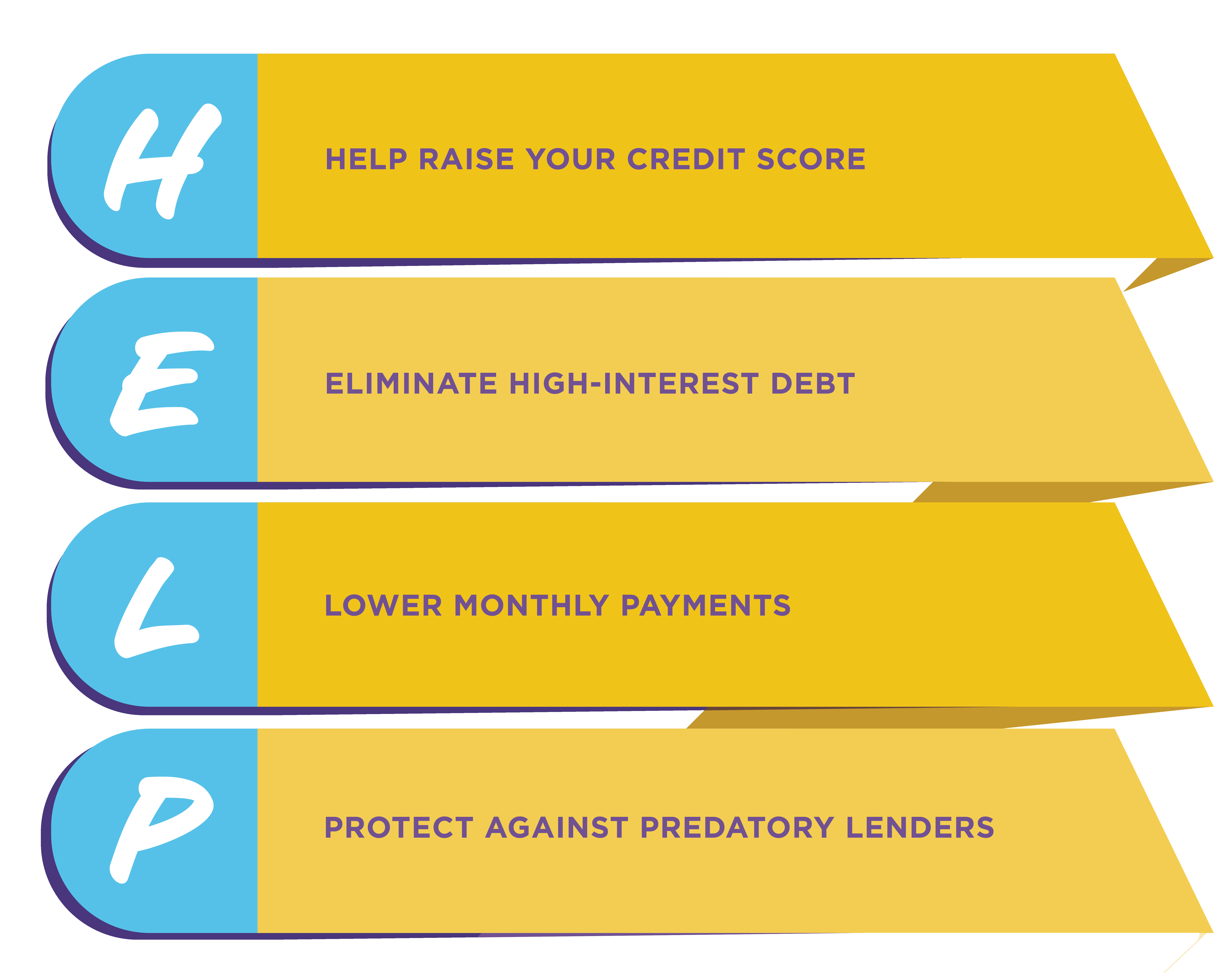

Our Credit Score Analysis can help you navigate your financial journey. Bad Credit, no problem. We can H.E.L.P. It's FREE and you don't have to be a member!

How does My Credit Score Affect My Interest Rate

A low credit score not only means you may have more trouble getting a loan, but you will probably end up paying a higher interest rate. Higher interest means higher monthly payments and paying more over the life of the loan. Check out the difference based on a $20,000 auto loan financed for 60 months:

| CREDIT SCORE | INTEREST RATE* | MONTHLY PAYMENT | TOTAL INTEREST PAID |

|---|---|---|---|

| 720+ | 7.25% | $400.81 | $4,049 |

| 681-719 | 7.75% | $405.76 | $4,345 |

| 640-680 | 9.75% | $425.94 | $5,556 |

| 601-639 | 15.50% | $487.26 | $9,236 |

| 546-600 | 16.75% | $501.23 | $10,074 |

| less than 546 | 18.00% | $515.43 | $10,925 |

*Rates are samples and are not necessarily those of CoastLife Credit Union. Visit our rate page for current rates.

What Is a Credit Score

Your credit score is a three digit numerical value that's based on information gathered on you by credit bureaus. It represents your creditworthiness and is used by lenders to determine your interest rate. It is also used by other industries such as insurance companies and apartment complexes.

What Can I Do to Raise My Credit Score

There are lots of little things that affect your score and a low score could mean higher rates for you. We can help! As your financial solutions partner, CoastLife CU will look for ways to RAISE your credit score, LOWER your monthly payments and ELIMINATE high interest rate credit card balances so you can start getting the interest rates you deserve! Schedule an appointment today to have one of our Credit Score Analysis (CSA) experts review your credit report with you. No credit, no problem. We can help you establish credit too!

What Is a Good Credit Score

When it comes to borrowing money, a good credit score is what we all aspire to. A credit score ranges between 301-850. Every lender has their own structure set forth to determine what is considered a 'good' credit score. Over 720 is typically considered good and below 600 needs a plan for improvement.